HEURISTICS AND COGNITIVE BIASES

This is Behavioural Economics

When making decisions people are influenced by other factors more weightened than logic.

Identifying and measuring the impact of those factors (heuristics) is the aim of behavioural experimental economics

Anchoring bias

Tendency to pay too much attention to the first piece of information we receive or to a previous reference

Example: in an auction, it is not logical to make an offer below the initial bid, even if this one is far above the real value of the product

Attentional bias

Tendency of our perception to be influenced by the thoughts that we consider as more important

Example: when we buy a car model and suddenly we notice that "everyone" drives the same car

Availability heuristic

It occurs when people give priority to the information they already know about a specific issue

Example: when one person states that a TV ad is not interesting at all, because it is not interesting for him/her and their closest environment

Bandwagon effect

It takes place when individual's thoughts and beliefs change if a large number of people think or believe in a different way

Example: if attendants to a work meeting do not write down their own thoughts in advance, it is very likely that all of them end up thinking in the same way

Barnum or Forer effect

We usually treat vague and general descriptions as if they were specific and detailed for our particular case.

Example: when we fill in a personality test, we often think that the questions are tailored for us, but actually they identify the majority of the population

Choice-supportive bias

Tendency to ascribe just positive values to one decision a posteriori, usually in a very subjective way

Example: when we spend 3,000 euros in a pair of shoes, arguing that they were half of the price and that you need good quality shoes for your everyday routine

Conservatism bias

People tend to put previous beliefs ahead of new, innovative ideas about a particular topic

Example: Nokia believed that it was only necessary to improve technical features of their existing mobile phone, without identifying the demand for the attributes of a smartphone in the market

Confirmation bias

People usually consider the information that supports their own hypothesis only and discard the one that goes against it

Example: if investors do not analyse the signals of a sudden change in the evolution of financial markets and stick to their old strategy, they may incur in huge losses

Framing effect

Due to this effect, people can react to a particular choice in different ways depending on how information about it is presented

Example: although the sentences "90 patients have survived" and "10 patients have died" in a month in a hospital include the same information, the reputation of that hospital may be interpreted in a slightly different way

Hindsight bias

Inclination to perceive an event as obvious and easy to forecast once it has taken place

Example: although today it seems obvious that the e-book would take over the written format, it was not that evident in the 90s, when the Internet was accesible only for a few

Hyperbolic discounting

Given two similar rewards, individuals tend to overvalue the one that is further in time.

Example: individuals usually discard 1€ today and prefer 3€ in one year and one day

IKEA effect

Subjetive preference for those items or activities that we have created by our own means, even if less useful or functional

Example: some managers do not consider good ideas developed out of the organisation, in favour of (possibly inferior) internally developed ideas

Illusory correlation

It occurs if we assume that there is a relationship between two variables even if there is no data that supports this idea

Example: we think that updating our Facebook profile with better content gives us more "likes", when the key variable is the time at which we add the new post

Negativity bias

Propensity of unpleasant memories to have a greater effect on our psychological state rather than positive or neutral ones

Example: entrepreneurs may not repeat twice if they had a bad experience when they first decided to set up a business, even if they have learnt from it and know how to correct their mistakes

Ostrich effect

Decision to ignore dangerous or negative information, even if it is important or necessary for us.

Example: according to various studies, many investors tend to check less often the value of their interests when the situation of the market is bad.

Outcome bias

Judge a decision based on the outcome, and not on the means to achieve it

Example: if you earn a lot of money investing in subprime mortgages, it does not mean that it is a very secure and recommendable investment

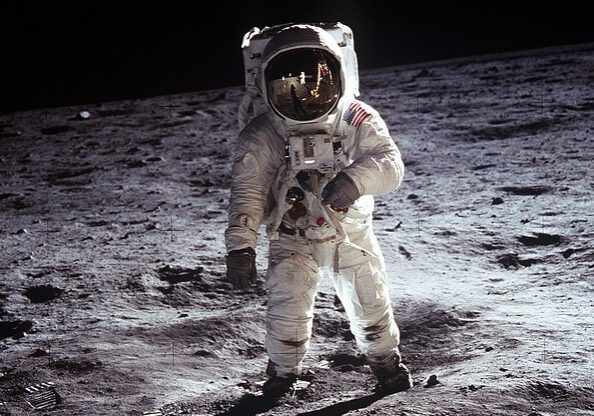

Overconfidence

It happens when a person trusts more his/her own decisions or judgements that he/she should from an objective point of view

Example: the Ukrainian Minister of Power stated the probability of a meltdown in a 0.0001% two months before the Chernobyl disaster

Recency illusion

It occurs when the latest information has more weight than older data when it comes to making a decision

Example: if you judge your customers based only on their desires today, you may miss important trends that took place 1 or 2 years ago

Stereotyping

Expecting a member of a group to have certain attributes typically associated to that group, without having analysed that specific person

Example: nowadays, it is a mistake to consider only housewifes as the only interested in cleaning products, as it usually happens in TV commercials

Zero-risk bias

Tendency to prefer the complete elimination of a risk even when other actions reduce more risk in aggregate terms

Example: in some surveys, respondents preferred to invest only in war against terrorism, rather than in reducing both traffic accidents and gun violence

Blind Spot

Tendency to recognise the power of bias in other people, but not that much in us.

Example: it has happened to you if you were relating all these biases to your brother, your friend and your neighbour...but never to you!